Congratulations to Lombard on their $16M seed round. We are thrilled to welcome them to the Polychain family!

Historically, Bitcoin’s proof-of-work consensus mechanism has prevented BTC holders from earning yield on their idle tokens—until now, thanks to our partners at Babylon. Their Bitcoin staking mechanism is a huge step forward for yield, but it still leaves (yield-bearing) tokens locked up. That’s why we were so excited when the Lombard team approached us with an ambitious vision: Bitcoin liquid staking that interoperates with the DeFi ecosystem.

There was a catch, though: Lombard wanted smart-contract-level security, despite the fact that Bitcoin doesn’t have smart contracts.

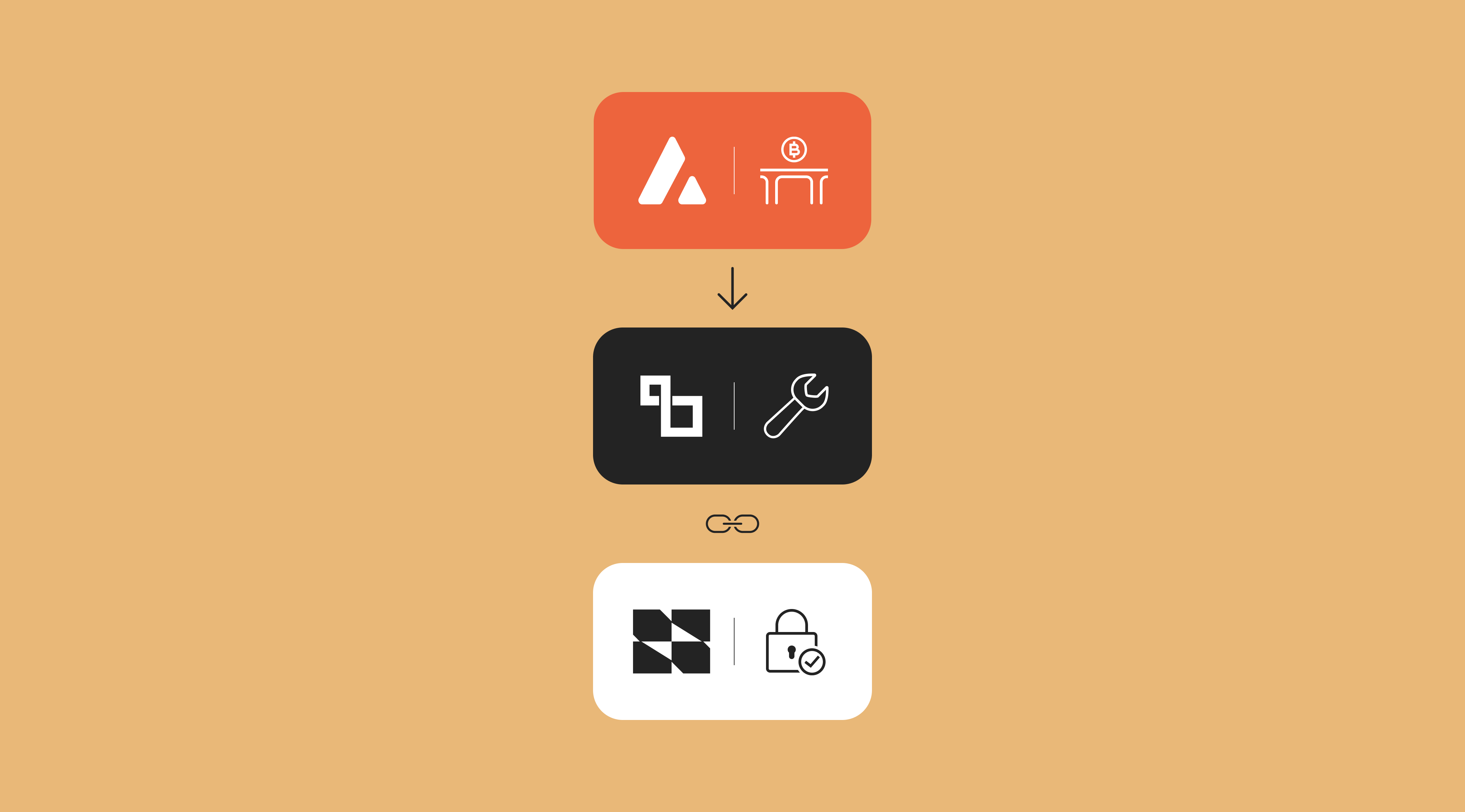

That’s where Cubist came in.

Overcoming security challenges in Bitcoin Liquid Staking

Because Bitcoin’s scripting language is significantly more limited than Ethereum’s, it’s simply not possible to create a Bitcoin smart contract that implements the necessary ingredients for a secure LST (e.g., staking pools and on-chain governance). Lombard wanted Cubist’s help to bring these industry-standard security controls to Bitcoin liquid staking.

Lombard’s LBTC is a novel, secure Bitcoin LST that builds governance on Cubist’s hardware-backed key management primitives. It uses Cubist’s policy engine to implement “smart contracts” for Bitcoin (stay tuned for an announcement 👀). As a result, users’ deposits can only be used to stake BTC (and not, for example, send that BTC to arbitrary addresses); similarly, Lombard requires multi-party approvals and time locks for sensitive protocol governance decisions.

See Lombard's announcement for more detail about how they're using CubeSigner to keep funds safe.

Named after the historic Lombard Street in London—a hub of financial activity since the Middle Ages—Lombard symbolizes a place where all participants are connected to opportunity. By adopting the Lombard name, we rebuild its legacy on digital blocks, transforming it into a modern nexus of innovation and connectivity.

Lombard is dedicated to creating opportunities on-chain with the development of LBTC. LBTC is a liquid yield-bearing representation of Bitcoin, designed for composability and access to opportunities in decentralized finance. Set to launch as collateral on leading decentralized finance protocols, chains, and Layer 2s this summer, LBTC is built with no security compromises. It has the potential to connect over $1.3 trillion of idle Bitcoin to decentralized finance and contribute to the sustainability and growth of the digital economy.